VAT in KSA

- tags

- Tax

VAT in Saudi Arabia #

registration for the VAT started from August 28, 2017

VAT is will be implemented in Saudi Arabia on 1st January 2018, as part of the GCC Unified VAT Agreement.

Details of Step of readiness #

VAT Law and Implementing Regulations #

Develop a detailed understanding of VAT Determine the tax policies of goods to be sold (5%, zero-rated, or exempt), for further information please visit VAT Implementing Regulations document Designate a point of contact in the company to deal with ZATCAon matters related to VAT

Accounting system and Chart of Accounts #

Establish a system for recording and archiving invoices Determine the VAT details of suppliers

Technical solutions #

Set in place a consistent means of display for the price of goods (all VAT inclusive) Issue sales receipts compliant with VAT requirements Align a system to record sales with VAT management requirements ZATCA has engaged with a set of PoS and accounting software providers. These solutions will support SMEs in implementing VAT. To find the list of PoS / accounting software providers which signed an MoU with ZATCA please click here.

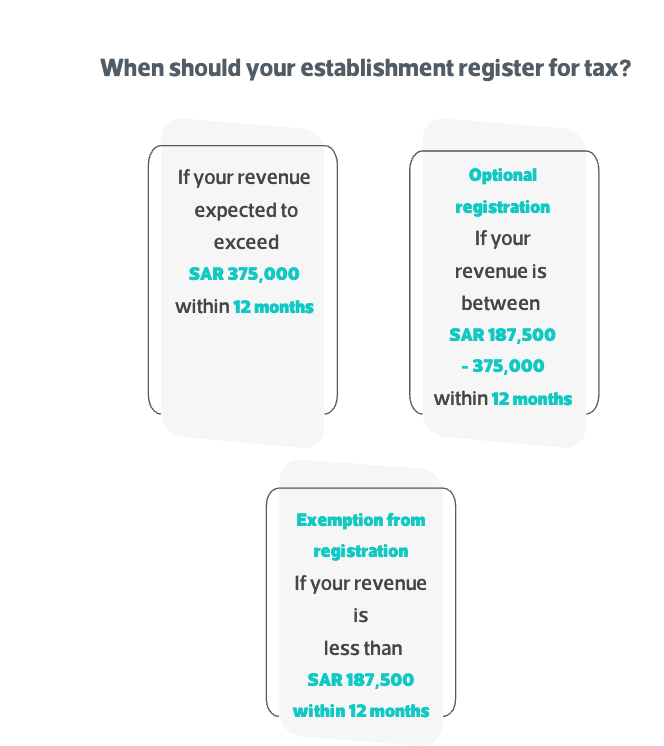

Who should apply for VAT no.? #

any business with an annual revenue over SAR 375,000 is required to register for VAT. ref

SAR 187,500 and SAR 375,000Businesses with this revenue can register for VAT no., this allows them to claim for the VAT return.SAR 187,500or less are exempted from registration

VAT #

When to pay VAT?

when revenue is expected to exceed 375,000 SAR or 100,000 $ 10% of a million dollar.

Revenue is the total amount of income, not profit.

when revenue is expected to exceed 375,000 SAR or 100,000 $ 10% of a million dollar.

Revenue is the total amount of income, not profit.

Revenue measurement

- Previous fiscal

revenues are calculated monthly and collected after 12 months to see if reaches mandatory threshold.

- Subsequent fiscal year

registration begins after the first month when revenue exceeds a threshold.

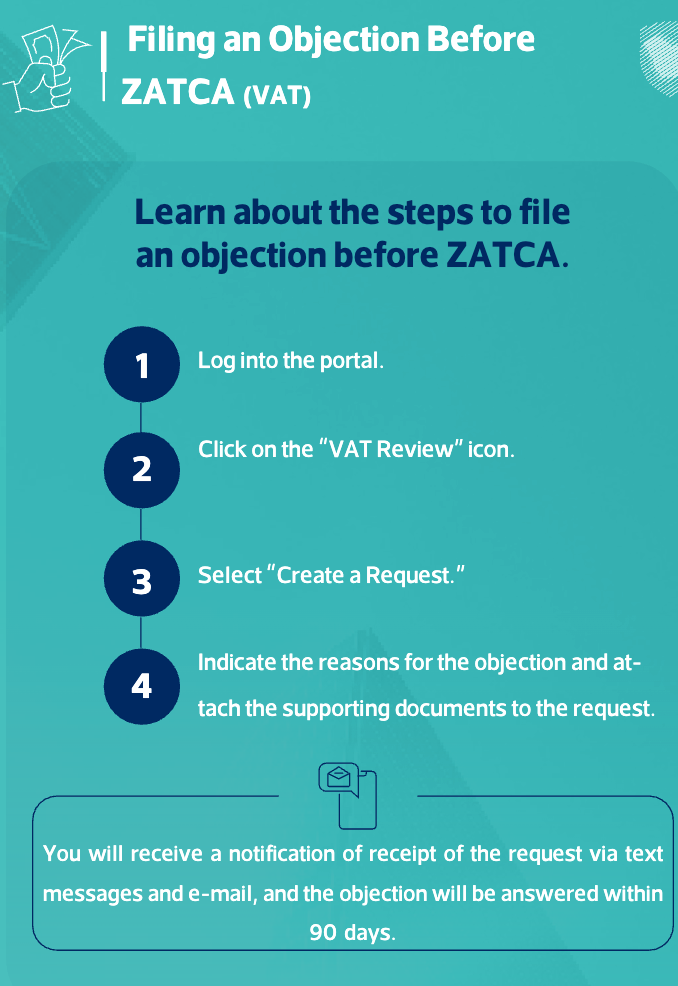

- Filing an objection for VAT

- VAT refund

Cancellation of VAT

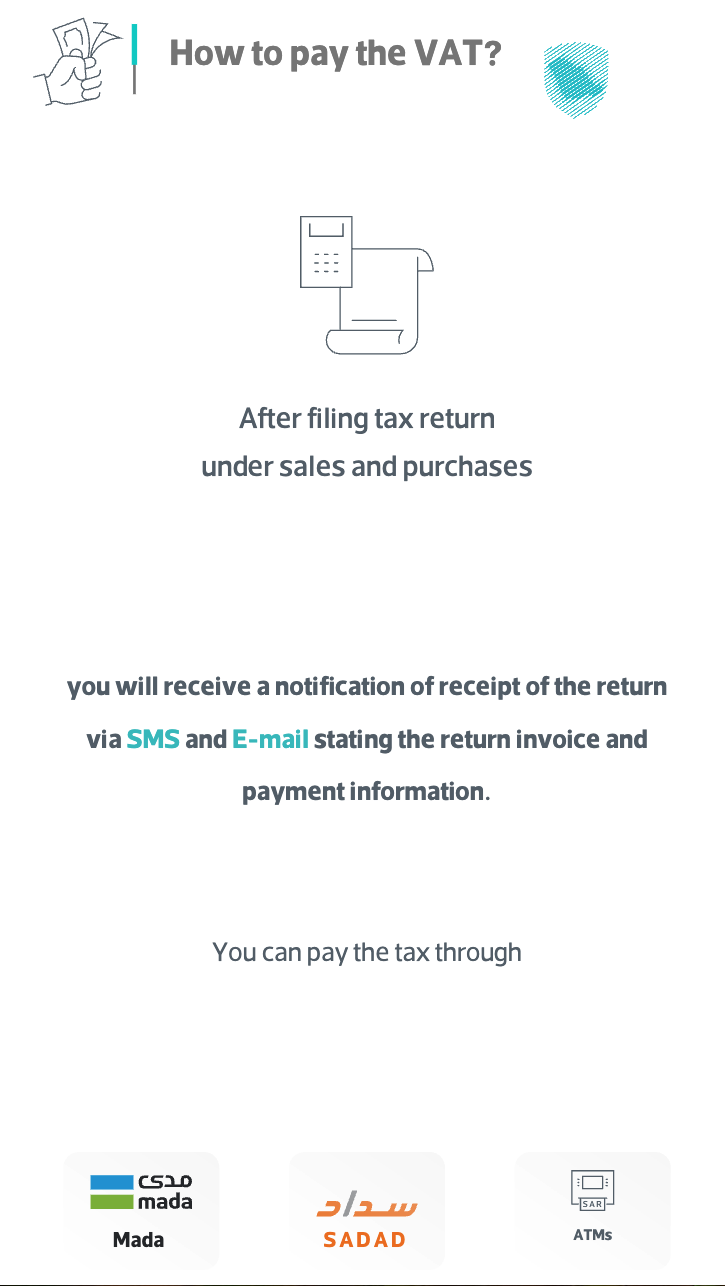

How is VAT payed?

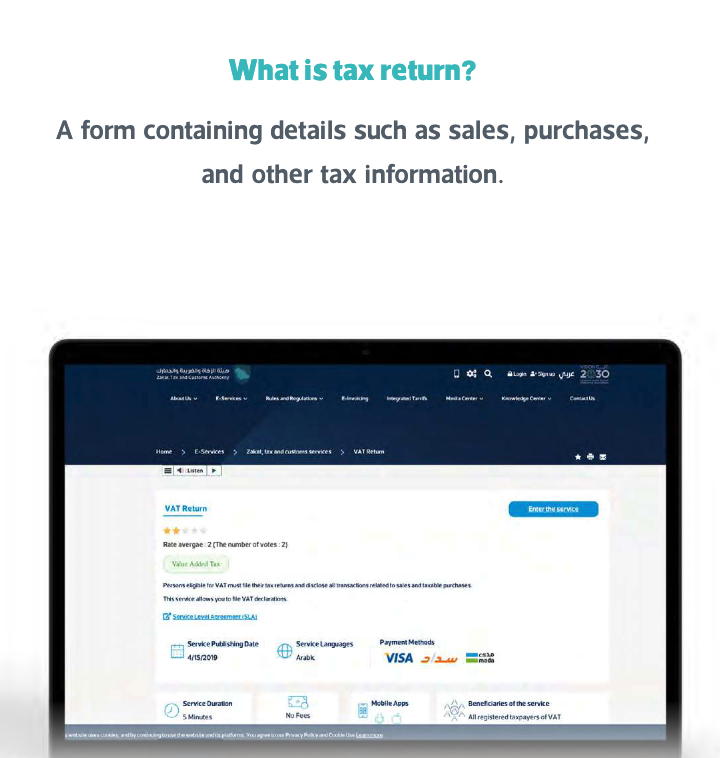

Tax return form

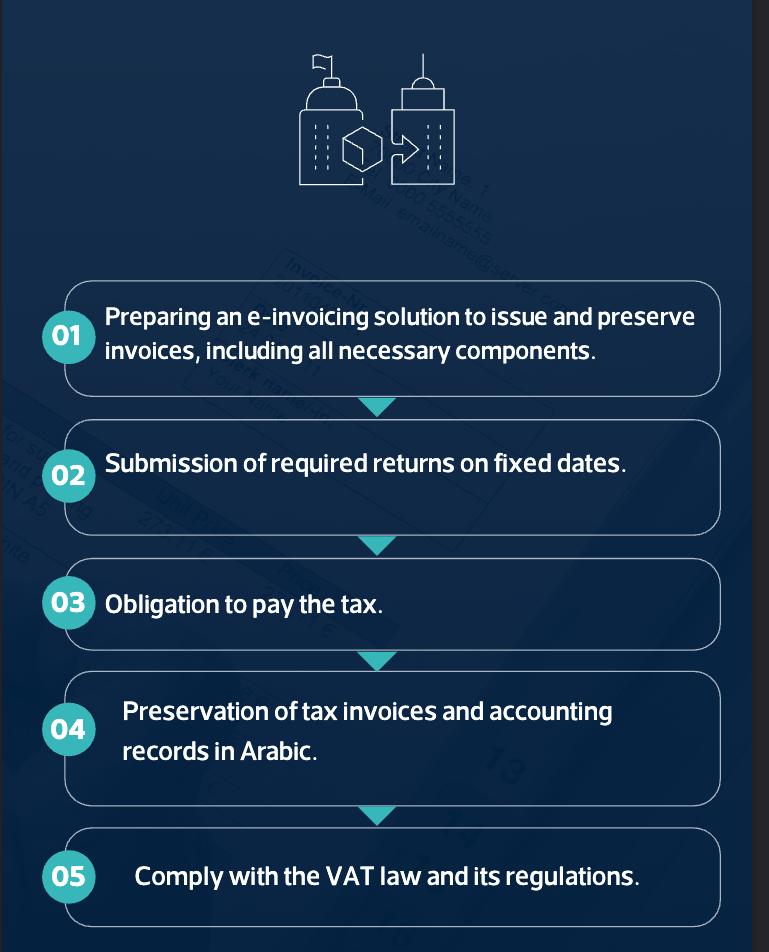

Obligation of Establishment(companies) subject to VAT

- E-Invoicing

- Submission of the required returns on fixed dates.

- Obligation to pay the tax

- Preservation of tax invoices and accounting records in arabic archiving of business data

- Comply with VAT law and regulations

Tax installments

- it is possible to pay tax in installments

- at least 20% should be payed initially

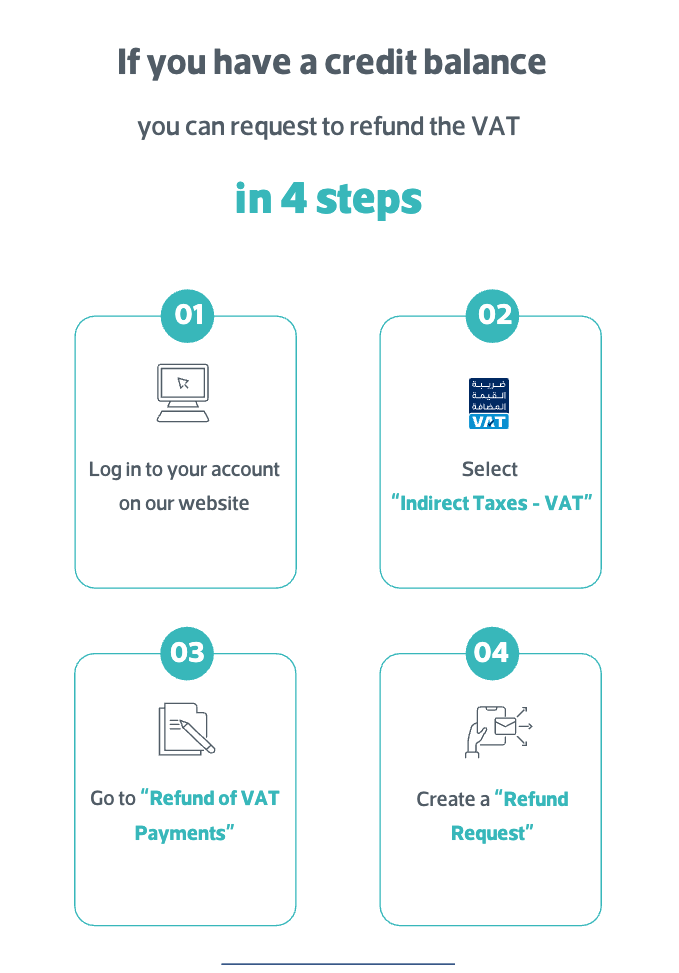

VAT refund

happens when VAT payed is more than collected VAT to return = VAT collected - VAT payed in B2B

VAT registration and return filing #

- Set in place a record keeping and account practices which address VAT requirements

- Set in place the

ability to assess VAT balance - Establish the

ability to pay VAT balancejak: pay VAT collected back to the government - For a further detailed readiness checklist for small and medium businesses, please click here

ZATCA has engaged with a set of PoS and accounting software providers. These solutions will support SMEs in implementing VAT. To find the list of PoS/ accounting software providers which signed an MoU with ZATCA please click here.

As a small or medium business, you have a variety of ways to find out about your VAT readiness status. The Zakat, Tax and Customs Authority (ZATCA) is committed to supporting you during this process to ensure your businesses are ready.

An indirect tax of 15% imposed on most goods and services

Frequency #

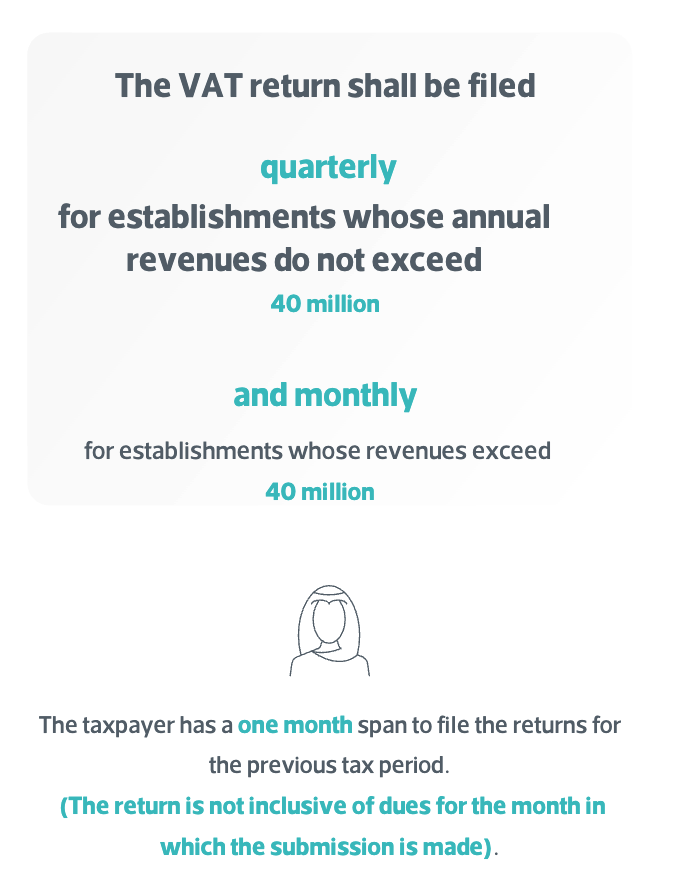

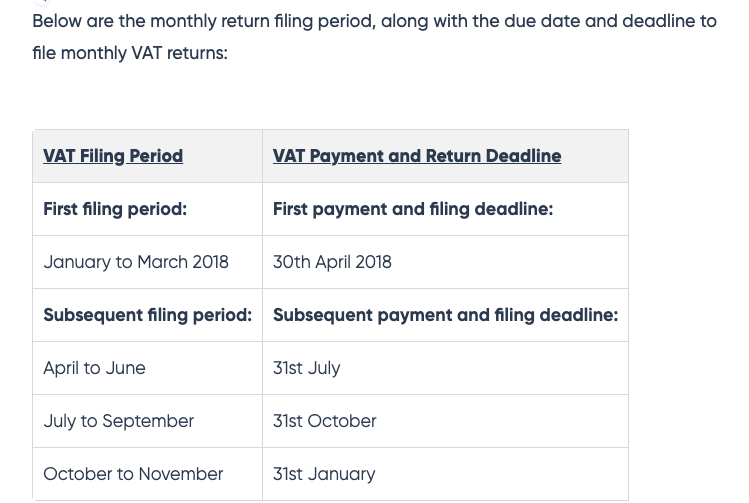

KSA VAT requires VAT return filing for a specific tax period, where the tax period could be either monthly or quarterly. ref

Monthly VAT returns

Businesses with an annual turnover of more than SAR 40 million are compulsorily required to file their VAT returns monthly.

The taxpayers must file their monthly VAT returns between the first and the last day of the month following the end of the tax period. For example, taxpayers must file VAT returns for March between 1st April to 30th April.

Quarterly VAT returns

Businesses with an annual turnover of up to SAR 40 million or less can file their tax returns quarterly.

The taxpayers can file their quarterly VAT returns between the first and the last day of the month following the end of the quarter. For example, taxpayers must file VAT returns for the quarter of October to December between 1st January to 31st January.

VAT return format #

- Output VAT = VAT on purchases (payable VAT)

- Input VAT = VAT on purchases (deductable VAT)

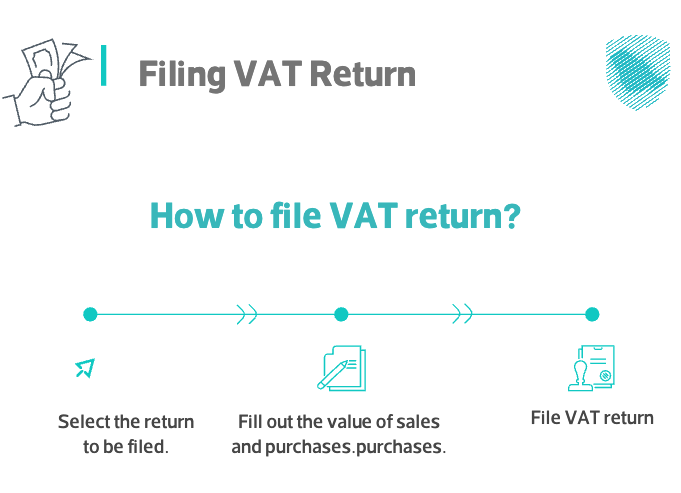

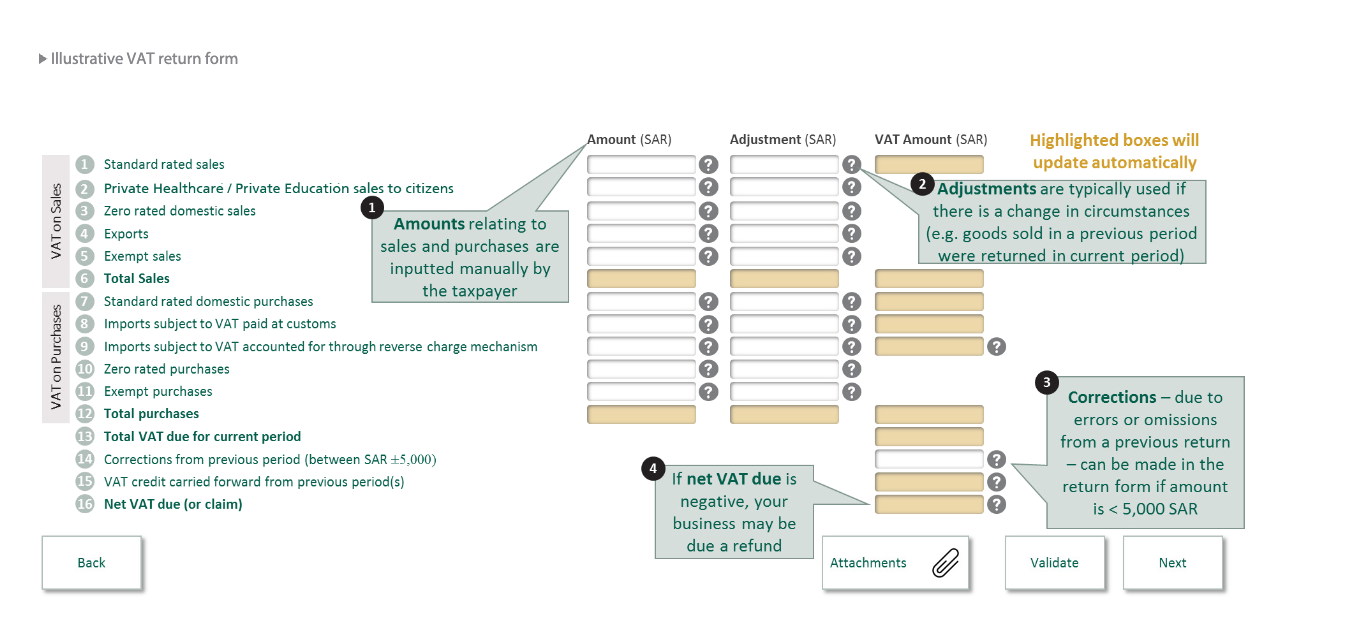

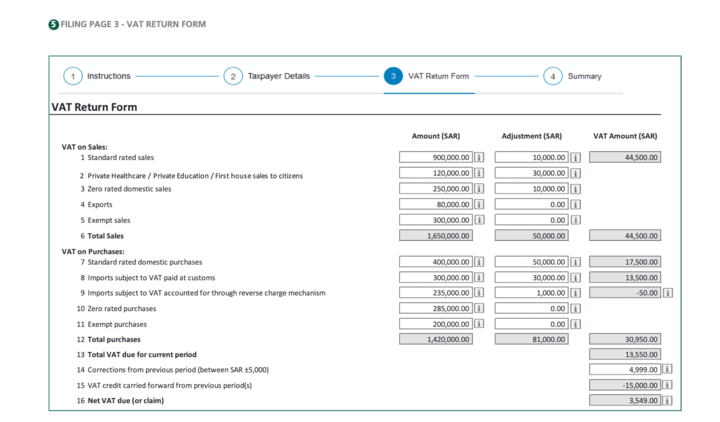

The VAT return requires taxpayers to provide information about the VAT collected on sales and paid on purchases. The form has 16 sections to cover all transactions. ZATCA divided the VAT form into two parts. The first part deals with output VAT (VAT on sales), and the second part deals with input VAT (VAT on purchases).

The taxpayer should fill in all details about the sales and purchases, including zero-rated sales/purchases, exports, exempt sales/purchases, and imports. However, the taxpayer can enter nil value if it is not applicable or no transactions are made in that section.

Deadline extension for VAT payment #

The taxpayers can request the authority to extend the VAT payment deadline if they are unable to pay VAT liability by the due date. The taxpayers should submit the details such as tax liability, tax period and the reasons for the deadline extension. The ZATCA can either approve or reject the extension request within 20 days.

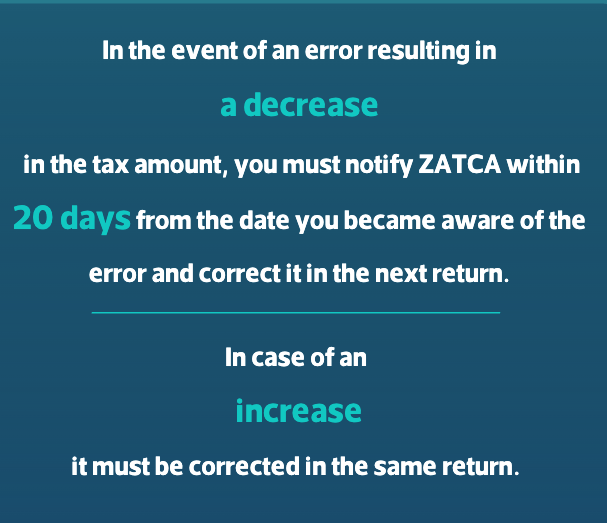

Amendments to VAT returns #

The ZATCA portal allows all taxpayers to amend the VAT return if the need arises to modify the already submitted details. However, to amend the VAT return, the taxpayer must fulfil the following conditions:

- The taxpayer must present reasons for amendments.

- Relevant documents are required to be attached.

- The taxpayer should also adjust the financial statements.

Also, the taxpayer should adjust the tax due (if the difference is less than SAR 5000 due to an error) in the next tax return.